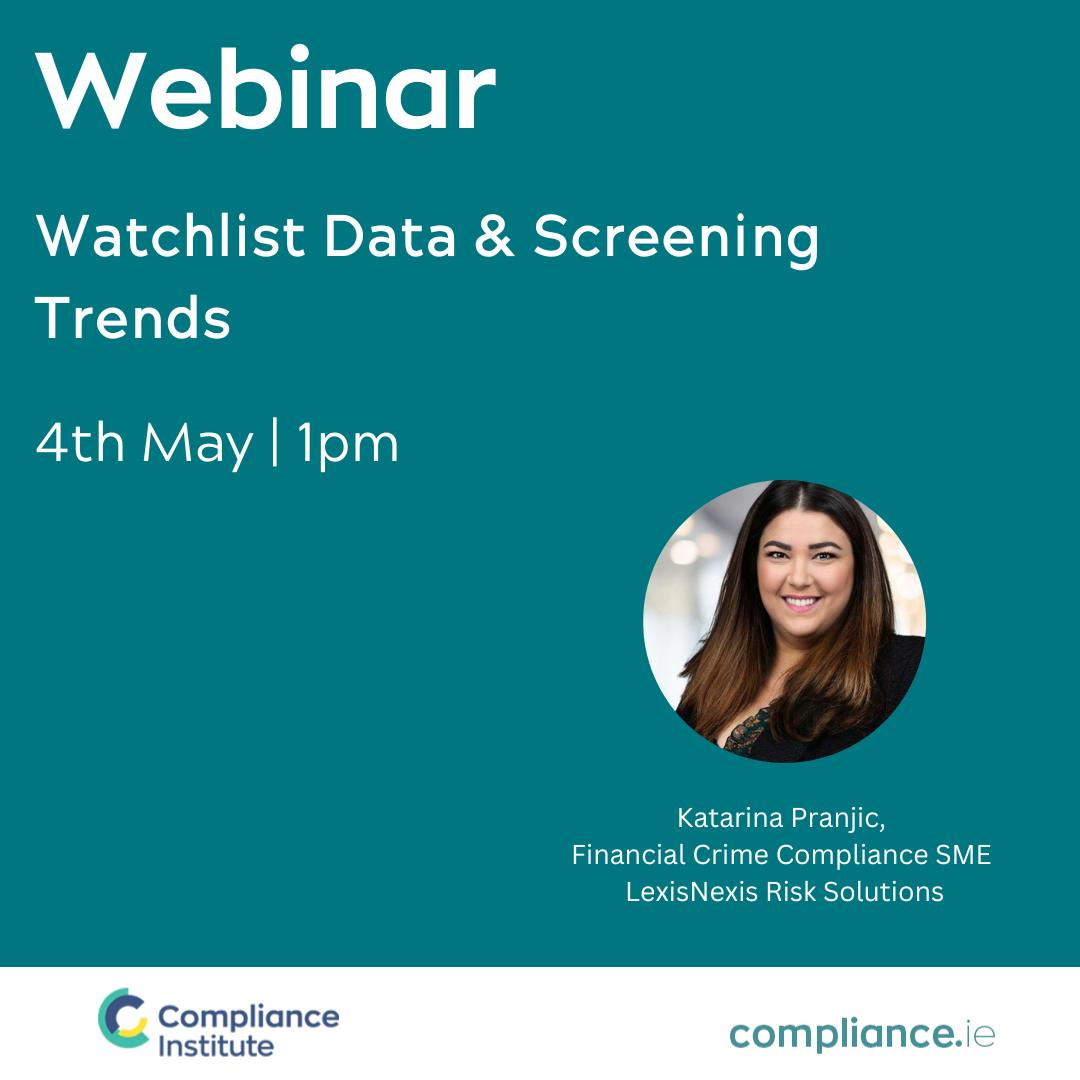

Watchlist Data & Screening Trends (Online)

Watchlist Data & Screening Trends

Webinar Details

Date: Thursday,4th May

Time: 13:00 - 14:00

CPD: 1 hour LCI, FCI (Compliance), CFCP

Fee: €25 for members, €35 for non members

Platform: GoToWebinar

Overview:

- What is watchlist data

- Segments and scope of watchlist categories

- Why we need watchlist data in AML processes

- When in the AML process do we conduct screening

- Recent watchlist screening trends (geopolitical influence on watchlist screening, evolution of technology post covid and in inflation times)

- Regulatory demand (regulatory storm and differences between US, UK and EU sanctions regimes)

- How is market responding to recent needs – where do vendors stop and compliance investigators begins

The Compliance Institute's CPD Programme is designed specially to support the compliance professional in developing the skills and competences required to perform their role and is also a requirement to maintain your Compliance Institute designation. For more information on Compliance Institute designations, click here.

For a full list of our upcoming CPD events, click here.

Katarina Pranjic, Financial Crime Compliance SME at LexisNexis Risk Solutions

Katarina is a subject matter expert in financial crime prevention. In her role Katarina is responsible for working with strategic customers and partners, industry analysts, press and regulators representing LexisNexis Risk Solutions in the market. She regularly assists on various strategic initiatives across UK and Ireland. She joined LexisNexis Risk Solutions from PwC, where she worked as a Risk & Compliance Manager in the Financial Crime Compliance / Risk Management areas. Katarina is CAMS-certified since 2016 and has more than ten years of experience in corporate risk management and financial crime compliance. Having worked as KYC analyst, AML supervisor, compliance manager, financial crime prevention consultant and FCC market planner, she has been accountable for all areas of financial crime prevention including customer screening, KYC / CDD, payment screening, risk assessment, policies set up, compliance consulting, AML audits assistance, AML seminars, digital transformation and generally in supporting customers efforts to identify and mitigate financial crime threats in various sectors and jurisdictions. In addition to designing and implementing AML programs and incorporating a broad range of vendor solutions, she also has experience with GDPR, FATCA and CRS. Originally from Croatia, Katarina enjoys engaging with industry practitioners across different markets and territories.